Schedule C For 2024 Taxes – Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The . By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments .

Schedule C For 2024 Taxes

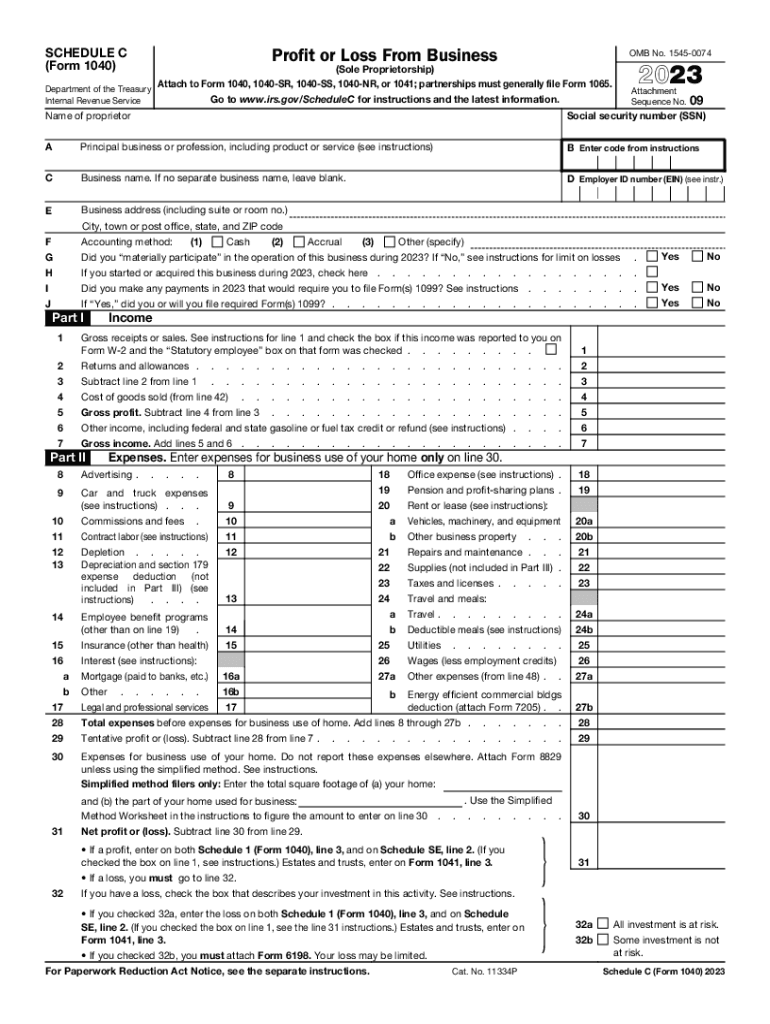

Source : www.kxan.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.com2024 Schedule C Masterclass | Mind Your Assets Tax School

Source : www.mindyourassets.academyHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comSchedule c tax form: Fill out & sign online | DocHub

Source : www.dochub.comMind Your Assets Tax School

Source : www.facebook.com2023 Instructions for Schedule C

Source : www.irs.govSchedule C For 2024 Taxes Harbor Financial Announces IRS Tax Form 1040 Schedule C : Complex tax situations typically include anyone with freelance income (1099 tax forms or Schedule C forms for self-employed The tax deadline this year is April 15, 2024. Due to state holidays . Students in graduate school or who aren’t attending college at least part time may be eligible for the lifetime learning credit, which is worth up to 20% of eligible expenses, with a maximum credit of .

]]>